Additive Manufacturing in Aerospace: How Can We Capitalise?

In 2018, the aerospace industry is under greater pressure and scrutiny than ever before. Increasing passenger loads and the rising demand for global travel are being coupled with the expectation that aircraft today must be more sustainable and efficient.

At the same time, rising oil prices and wage inflation have placed even greater emphasis on OEMs to continually reduce cost and streamline operations. These market conditions provide a great environment for innovation to thrive and additive manufacturing is amongst the technologies with the potential to make a big difference to these challenges across the aerospace, space and defence sectors.

![]() Why all the excitement?

Why all the excitement?

In 2016, the total additive manufacturing market size was estimated $6.063 billion, with aerospace accounting for 18.2% of the overall market. However, by 2022, it is estimated that the market as a whole will increase to $26.2 billion.

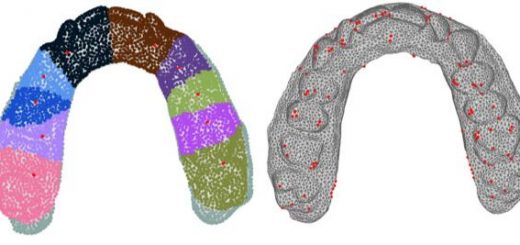

Additive has previously been described as a revolutionary technology as it enables a design freedom that wasn’t previously possible through conventional manufacturing. Additive can now make it possible to design organic structures, enabling significant weight reduction, simplification of complex assemblies (consolidation of multiple parts into one) and increase performance benefits.

In addition, because the process builds the shape layer by layer, the material waste is minimal. To put this into perspective, a typical aerospace component has a material waste of between 90-99%. This is referred to as the ‘buy to fly ratio’. So by lowering the buy to fly ratio, you open up material options at the design phase that weren’t previously commercially viable using conventional manufacturing methods.

Other associated benefits include a faster time to market. As the process of design, building and testing is considerably shorter than a casting or forged method, additive manufacturing allows an increased design window during product development.

A big early adopter for additive manufacturing has been the space industry, which deals with very complex (and often bespoke) components. Additive manufacturing has allowed them to optimise the design space and produce very high complexity single pieces without incurring a premium cost and high lead-times associated with conventional manufacturing.

![]() The reality

The reality

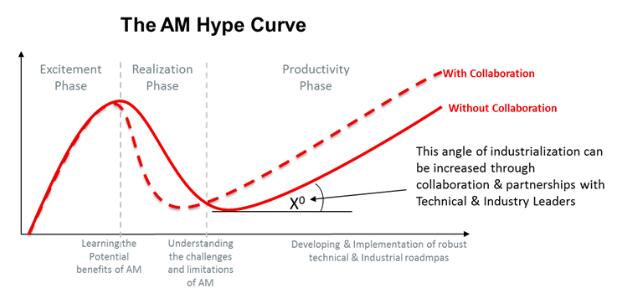

The aerospace industry has been exploring additive manufacturing for over a decade. Great strides have been made in understanding the technology, as well as its limitations. It is only when one starts exploring the material science that occurs through the process chain (powder alloy, AM processing & heat treatment) that the technical roadmaps to industrialise the technology become clearer. A step change in thinking comes when additive manufacturing is considered as a process that makes a material, not a shape. The shape is a by-product of the material, not the other way around.

Two significant interdependencies are required before additive manufacturing can be considered an industrial manufacturing process;

1. Firstly ‘we’ as part of the industry must provide confidence that robust processes can be developed which demonstrate high repeatable quality on single or multiple machines.

2. Secondly, the manufacturing processes must enable commercial viable business cases.

These challenges need to be overcome for additive to be scaled for large-scale production.

![]() Success stories

Success stories

We have seen a number of early success stories. Parts are being qualified and flying for different aerospace, space and defence applications using Single Part Qualification. This method targets the problem of repeatable quality by inserting high levels of test and validation to ensure the quality of a single part in a single machine with a single material.

Whilst this is generating positive results by getting additive manufacturing parts flying, it can mean extended qualification time and high process costs attributed to the test and validation methods (CT Scanning & X-Ray etc.). However, the biggest issue still remains that this is a short-term fix to get the industry moving and often involves significantly high scrap rates as parts are rejected during the validation.

Some of the case studies to benefit from single part qualification include; converting multiple part assemblies to a single or reduced part count, reducing significant weight of the part; simple ‘part substitution’ where additive manufacturing is cheaper than the conventional method; reverse engineering legacy parts where the conventional supply chain no longer existed; or even using additive manufacturing to create bespoke fixtures to support conventional manufacturing processes.

![]() Overcoming challenges

Overcoming challenges

The amount of success stories are currently capped because of the cost drivers in the additive manufacturing process. The key cost drivers include build speed, capital equipment, powder, quality validation, consumable and utilities, operational effectiveness, labour-intensive post processing and costly surface finishing. Whilst some of these drivers can be tackled internally, several of the significant cost drivers (equipment, consumables, powder etc) should be driven through collaboration as an industry-wide programme.

The final challenge is collaborating to create common data sets and standards. With industrial OEMs, academia, technology providers and regulatory authorities all working independently or in consortiums, we are seeing a level of data sharing, however, the level of duplication must be significant, both in data sets and standards development.

Source:wearefinn.com

Recent Comments