Lincoln Electric Buys Baker Industries

Lincoln Electric Holdings, Inc. LECO has completed the acquisition of Baker Industries, Inc. (“Baker”) and its related assets. Based in Detroit, Michigan, Baker Industries is a privately-held company, and a provider of parts, fixtures and custom tooling for automotive and aerospace markets.

The latest acquisition is expected to boost Lincoln Electric’s automation revenues by roughly $500 million in annualized sales. Terms of the transaction remain undisclosed.

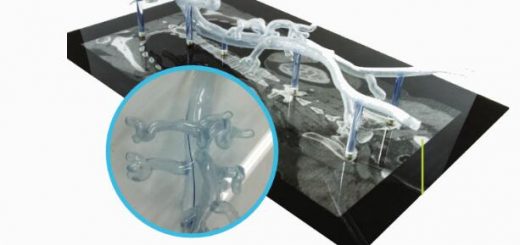

Baker Industries features extensive in-house design and manufacturing capabilities, such as fabricating, machining, assembly and additive manufacturing. Moreover, the company’s operations maintain stringent aerospace quality-management standards and are Nadcap accredited as well as AS9100D certified.

The acquired company Baker will complement Lincoln Electric’s automation portfolio and its upcoming metal additive manufacturing service business which will launch in middle of the current year. Interestingly, Lincoln Electric’s Ohio-based new metal additive business will manufacture large-scale printed metal parts, prototypes and tooling for industrial and aerospace customers, leveraging its competency in software development, metallurgy and automation.

This is likely to act as a catalyst for Lincoln Electric. Notably, the Baker Industries operation, along with the new metal additive manufacturing development center, will provide customers an additive manufacturing platform to improve their designs, lead times and quality in their operations.

Additive manufacturing is an important and major growth area in automation, while Baker’s capabilities and know-how will position it well for Lincoln Electric’s additive manufacturing services, and expand presence in automotive and aerospace end markets.

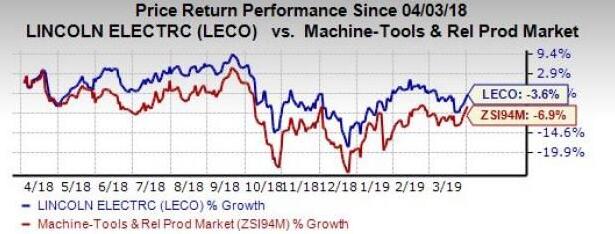

Coming to the price performance, Lincoln Electric’s shares have lost 3.6% compared with the industry’s decline of 6.9%.

Lincoln Electric has increased its investment in research and development, and continues to roll out several solutions in the automation solutions market. These product launches are likely to aid growth. The company continues to invest in long-term strategy for automation in support of its 2020 strategy initiatives.

It also continues to witness double-digit organic sales growth in its three major end markets — automotive, heavy industries, energy and construction infrastructure. Additionally, the company’s focus on commercializing innovative products and cost-cutting initiatives is likely to stoke growth.

In December 2018, Lincoln Electric acquired Inovatech Engineering Corporation and its related assets to boost its automated cutting solutions and application expertise for structural steel applications. The acquisition will primarily add to Lincoln Electric’s Harris Products Group’s performance. In the same month, Lincoln Electric also acquired Coldwater Machine Company, Pro Systems LLC and related assets to expand its portfolio of automated cutting and joining solutions.

This January, Lincoln Electric purchased the soldering business of Worthington Industries. It has also agreed to buy certain brazing assets of Worthington. These buyouts will enhance the company’s product portfolio, accelerate growth in the retail channel and aid its Harris business. The above-mentioned acquisitions are expected to contribute nearly $85-$90 million in revenues this year.

Source: Yahoo

Recent Comments