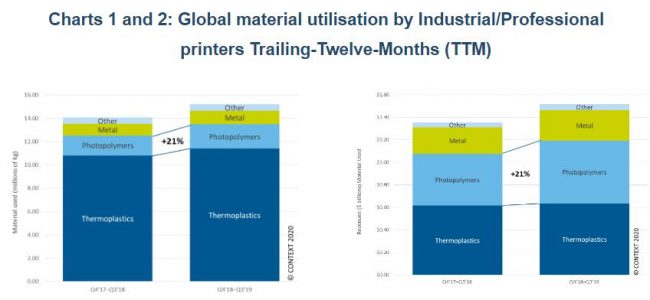

Photopolymers and Thermoplastics Shine in 2019 as Installed Base of 3D Printers Grows

13 February 2020 –The Industrial/Professional printer market (that is, for all printers above $5,000), has seen a +8% rise in polymer material utilisation over the last twelve months. Within polymers, photopolymers have seen the most significant near-term growth with volume used and revenues generated from use both seeing growth of +21% over the trailing twelve months (TTM) through to Q3 2019. For thermoplastics, although the overall increase in utilisation was up only +6% for the period, the powder-based side of this market saw good growth thanks mostly to a rising installed base of HP multi-jet fusion machines across the globe.

Image via CONTEXT

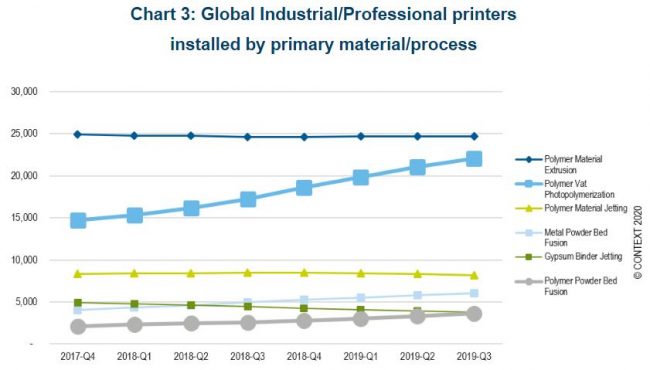

For Photopolymers, while there is an underlying increase in material utilisation as the market shifts from one principally focused on prototyping to one where mass production is also a key usage, near-term increases in material sales were more the result of a growing base of installed printers for traditional 3D printing uses. One such market which has traditionally embraced 3D printing for its unique ability of mass customization (that is, tweaks to each individual product manufactured) is dentistry. Photopolymer utilisation for this historically strong dental sub-sectors was particularly strong in the TTM to the end of Q3 2019, seeing a +29% increase in throughput. Increased photopolymer utilisation was also supported just in general by the accelerating installation of vat photopolymerisation printers in the TTM to Q3 2019 which were up +28% from a year before. Strong sales of all price-classes* of Industrial/Professional stereolithography printers from the likes of 3D Systems, EnvisionTEC, UnionTech and Carbon were seen, helping to grow the installed base. Overall shipments of stereolithography printers – laser based, LCD, DLS/CLIP and especially those leveraging DLP engines – outpaced the retirement rate of legacy printers in the field, leading to a larger operational base of Industrial/Professional printers which resulted in accelerated material usage.

Image via CONTEXT

Image via CONTEXT

The thermoplastics market is even larger than the Industrial/Professional photopolymer market. This part of the 3D printing polymers space is dominated by material extrusion machines but recent growth in material utilisation is linked to powder bed fusion (PBF) technologies. The period Q4 2018 to Q3 2019 saw a huge increase of +41% in the number of polymer PBF printers installed, driven by growing sales of HP’s Multi Jet Fusion technology. HP offers both Industrial* price-class printers, for mass production, and Design* price-class printers, mainly for more typical 3D printing applications like prototyping and short-run production.

* 3D printer segment by price class: INDUSTRIAL ≥ $100K, DESIGN = $20K–$100K, PROFESSIONAL = $2.5K–$20K, PERSONAL ≤ $2.5K (excludes do-it-yourself DIY kit printers)

Source: CONTEXT

Recent Comments