Israeli 3D Printing Co Nano Dimension Set for Major Acquisition

Israeli electronic components 3D printing company Nano Dimension (Nasdaq: NNDM), which has raised an additional $250 million on Wall Street, looks set to make a large acquisition. Despite having negligible revenue, the company has raised $590 million in four offerings in the past month and has raised $657 million since the end of the third quarter as it takes advantage in the boom in tech shares on Wall Street.

The company’s share price has risen 1,300% since March to give a market cap of $1.2 billion. The company’s market cap is similar to that of another Israeli 3D printing company Stratasys Inc. (Nasdaq: SSYS), which had revenue of nearly $400 million between January and September 2020, while Nano Dimension had revenue of $1.5 million during that time.

As with the previous capital offerings, ThinkEquity acted as underwriters for the offering, which was supported by Advs. Oded Har Even, Reut Alfiah and David Huberman of the Sullivan & Worcester law firm.

Nano Dimension announced, as with its previous capital raising rounds, that the new funds are required for working capital and general business need that could include ‘strategic opportunities,’ including acquisition of companies. The amount of capital raised by Nano Dimension, which itself has very modest operations, suggests it is preparing for a large acquisition.

Six months ago Nano Dimension hired US investment bank Needham to advise on acquisitions, in the US in particular, so that it could add complementary products or technologies in the electronics sector in order to expand the company’s distribution channels.

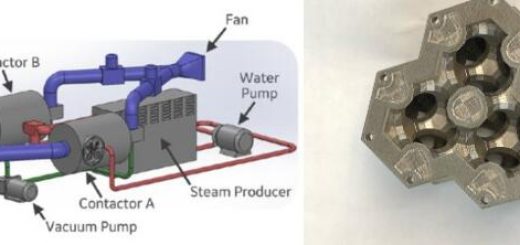

Nano Dimension delisted from the Tel Aviv Stock Exchange earlier this year, before the major jump in the company’s share price, which followed a technological breakthrough with the company’s DragonFly device now able to print 3D printed circuit boards (PCBs).

Nano Dimension CEO Yoav Stern said recently, “We are adjusting our focus in order to leverage our strong cash on the one hand and the clam on the markets as a result of the continued influence of Covid-19. While Wall Street is behaving unstably at the moment, on ‘main street’ there is a continuing slowdown following the closure of factories and delays in capital expenditure. This is an environment that allows Nano Dimension to make effective use of the support of its shareholders and we have at the moment two targets on which we are focusing: speeding up and promoting our R&D, and at the same time looking for a private company to acquire at the right price whose value has fallen, and that is synergetic.”

Source: GLOBES

Recent Comments